Report Finds Lack of Equity in the Cook County Property Tax Assessment Process

A new report by the Civic Consulting Alliance, in partnership with Cook County government, confirms that equity issues exist in the Cook County property tax assessment system. These inequities were first reported by the Chicago Tribune and ProPublica Illinois, who engaged in many of the same metrics and studies utilized in this report.

ICPR has also been active on this issue, proposing key transparency measures and internal controls utilized by many other large counties across the United States. Click here and here for ICPR’s reports on this topic.

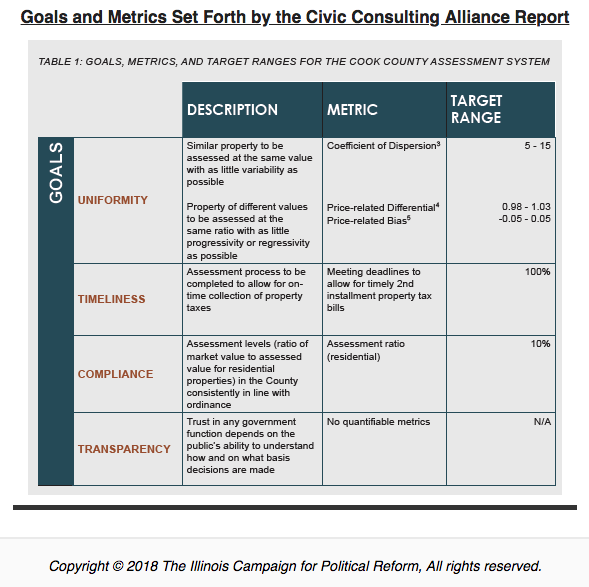

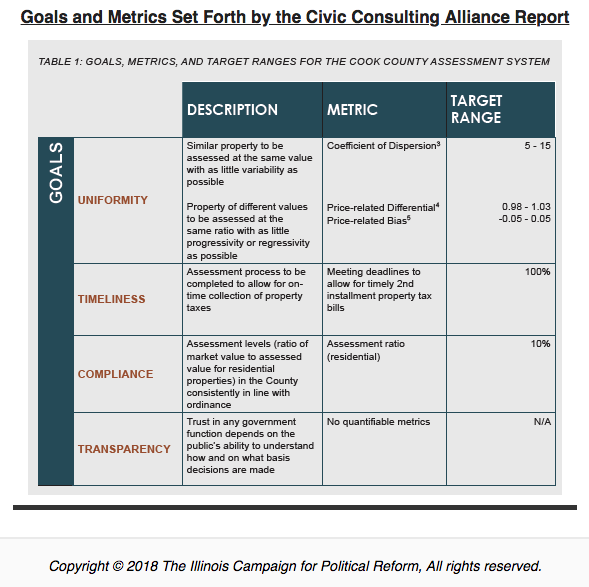

In the Civic Consulting Alliance Report, certain goals are set forth to ensure that the assessment process is functioning at the highest possible standard. As shown in the chart below, specific metrics have been put in place to determine uniformity, timeliness, and compliance. No metrics have been put in place yet to measure transparency, which is another key part of the process. Recommendations from the CCA may come in later phases of the report.

Based on practices utilized in other large counties in the U.S., ICPR recommends the following goals and metrics be put in place to achieve transparency in the Assessor’s Office:

- Publishing annual reports, which include a summary of internal controls, assessment trends, and other information as provided in this excellent example from Los Angeles County, California

- Explaining methods for assessment, and any adjustments the office makes to these processes each year

- Providing results of COD studies to the public, including any plans to make adjustments based on their findings

Coefficient of Dispersion (COD) studies, used by the Chicago Tribune, ProPublica Illinois, and the Civic Consulting Alliance report, are also an essential tool for measuring equity in the assessment process. COD studies should become a mandated accountability tool for Cook County during each property tax cycle. The Illinois Department of Revenue can help perform these studies, as is the practice in other states across the U.S.

CLICK HERE to download the report.

Back